Orient Futures Shanghai and the China market

As a regulated broker, Shanghai Orient Futures has amassed 4.3 billion CNY in registered capital and achieved 100 billion CNY Margin scale. The firm has ranked 1 in trading volume for over 3 consecutive years which signifies its position in China’s market.

Orient Futures Shanghai provides onshore services to a diversified client database, this includes tier 1 investment banks, global market makers, quants, trading firms, and HFT clients. In addition to onshore services, Orient Futures Singapore is a direct wholly owned subsidiary of Shanghai Orient Futures Co., LTD and an indirect subsidiary of Orient Securities Co., Ltd.

As an international arm of Orient Futures Shanghai, traders that are located beyond China’s borders can trade with Orient Futures Singapore as an overseas intermediary. The firm currently holds memberships at the Singapore Exchange (SGX), Asia Pacific Exchange (APEX), and Intercontinental Exchange Singapore (ICE SG), and traders are welcome to explore those options as well.

Why trade in China’s market?

Regular development of the China futures market has created a large potential for traders. Currently, foreign participation is only at 3%-5%, which is significantly lower than in most developed and emerging markets. This means that there is room to maximise trade opportunities, discover varieties of products, and trade at scale.

Adding to the boundless opportunities is the high investment value of China’s economy. In 2022, the China futures market registered a trading volume of 6.7 billion lots with a turn-over of 534.934 trillion RMB. The trade market has continued to maintain such trade volumes through the internationalisation of CNY and low market correlation which continues to draw trade.

Among the five exchanges, ZCE registered the highest trading volume of 35.42%, while SHFE registered the highest turnover of 26.41%. Other than the established exchanges, GFEX has also launched its first product, which is the industrial Silicon in 2022.

How To Access China’s Futures Market

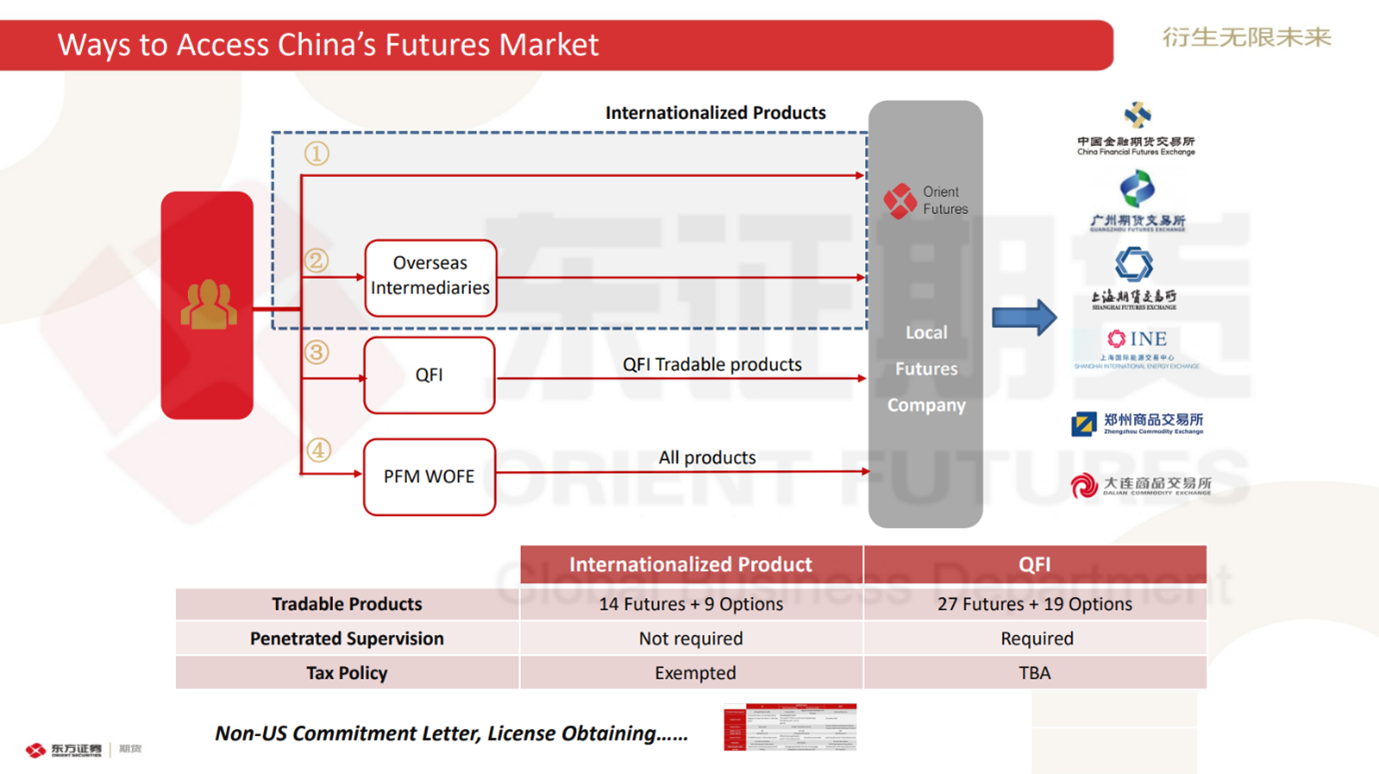

Figure 1: Source: Orient Futures Shanghai: Ways to access China Futures Market

Access to China’s Futures market has been made more accessible with the diversification of schemes. As shown in the above diagram from Orient Futures Shanghai, traders can choose to trade through overseas intermediaries (Orient Futures Singapore), QFI (Qualified Foreign Investor) schemes, or PFM WOFE. Currently, there are 14 futures and 9 options available in the internationalized product schemes, 27 futures, and 19 options available in the QFI scheme. (All available information can be found in the article attached to this link).

What Products Can I Trade Through QFI and Internationalised Product Schemes?

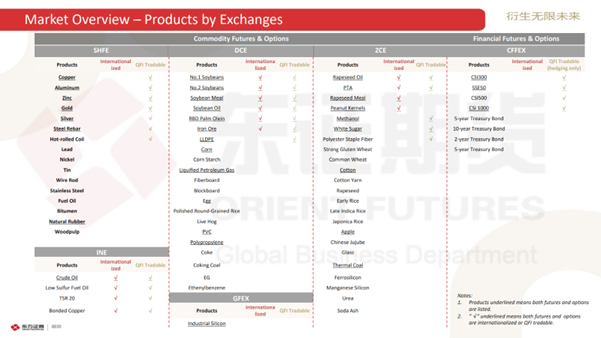

Figure 2: Source: Orient Futures Shanghai: Webinar: How to Participate in Trading Internationalised Products.

Currently, international participants can trade in some of the high trading volume or popular products including coking coal and iron ore from DCE or Rapeseed from ZCE. Nonetheless, though internationalised products have increased, clients that are under the QFI scheme will still enjoy a larger investment scope.

The main difference between both schemes is largely from SHFE metal products, precious metals, and CFFEX index futures and options.

China’s Economic News

From the International Monetary Fund (IMF), it is expected that China’s economy will rebound this year as mobility and activity pick up after the lifting of pandemic restrictions. However, while China’s economy is expected to expand by 5.2 percent this year, the contraction in real estate remains a major headwind, and there is still some uncertainty around the evolution of the virus.

From China’s projection note in the OECD Economic Outlook from November 2022, it was also stated that the infrastructure investment will pick up, partly offsetting weaker real estate investment.

From the Chinese government, monetary policy has become more supportive while major state lenders cut the deposit rate in a coordinated fashion in September for the first time since 2015.

For traders that intend to buy or sell futures within this period of time, it is advised to keep track of market conditions.

Start Trading With Orient Futures Singapore

Being an Overseas Intermediary of Shanghai International Energy Exchange (INE), Dalian Commodity Exchange (DCE), and Zhengzhou Commodity Exchange (ZCE), when foreign clients participate in internationalised futures contracts in these Chinese markets with us, they have direct access to trading, clearing, and settlement. Our parent company, Shanghai Orient Futures, is the largest broker in terms of aggregated volume across the five regulated exchanges in China.

Orient Futures Singapore also currently holds memberships at the Singapore Exchange (SGX), Asia Pacific Exchange (APEX), and ICE Futures Singapore (ICE SG).

We provide premium customer service at an affordable cost to all our clients. Our team will be there for you 24 hours on trading days to provide a one-stop portal for all your trades, with simple processes and an intuitive user interface that has low or near-to-zero latency.